2021年巴郡股東會精華出爐!股神巴菲特提5大投資重點 附股神英語原文|三火木

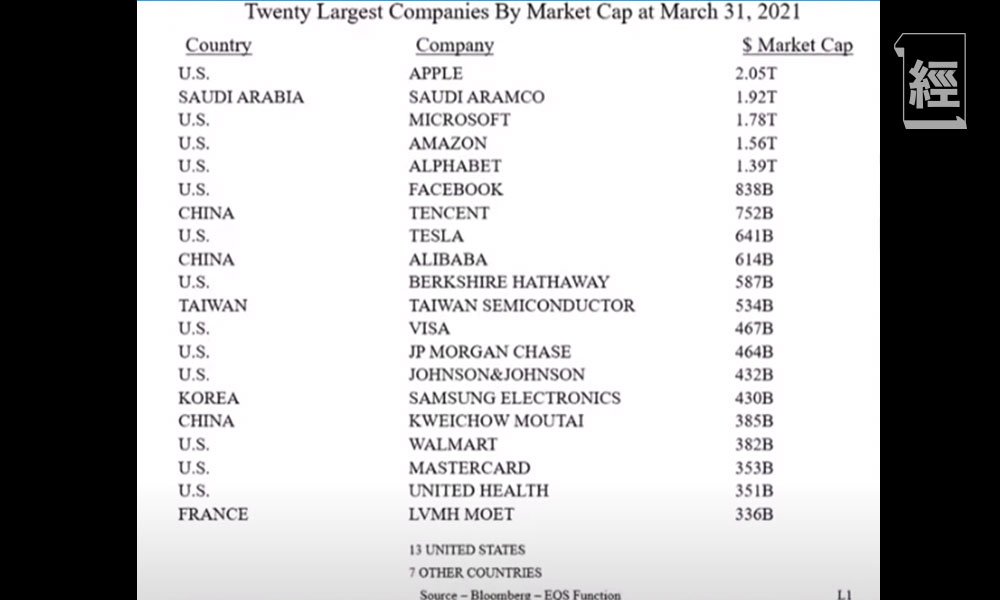

在問答前,巴菲特提到全球市值最大20企業,當中頭6位中有5位仍然是美國企業,以此證明美國並非如部分人所說的已經變得弱了。

(Warren Buffett: the top of the top six companies, five of them are Americans. So when you hear people say that America hasn’t done, it’s not working very well or something of the sort, in the whole world of the six top companies and value, five of them are in the United States.)

而有趣的是巴菲特邀請大家猜猜上述20間市值最大的企業有多少間可以在30年後仍然在20大名單上?可能是這20間當中的極少數,又或者現時這20間企業到將來已被淘汰。這是投資者在選擇上的長遠考慮,誰可以一直增長保持領先市值地位?

(Warren Buffett: I would like you to do is look at that list for a minute or two, if you want to, and then make an estimate, make your own guess, how many of those companies are going to be on the list 30 years from now. Here they are, these powerhouses. And how many would you guys think would be on the list? Well, it’s not going to be all 20. It may not even be all 20 today or tomorrow.)

然後巴菲特又拿出1989年的20間最大市值企業來嚇嚇大家,原來1989年(30年前)的頭20大市值企業(包括IBM,Exxon等等)已經全部都被「踢出」20大市值,沒有一間可以抵擋後來者居上。

(Warren Buffett: And if you look at the top 20 from 1989, there’s two things that we should grab your interest. At least two. None of the 20 from 30 years ago, are on the present list. None. Zero. There were then six US companies on the list and their names are familiar to you. We have General Electric, way of Exxon, we have IBM Corp. And these are, they’re still around. Merck is down there at number… None made it to the list 30 years later, it was zero. And I would guess that very few of you, when I asked you to play the quiz a little, a few minutes ago, would’ve put down zero. And I don’t think it will be zero, but it is a reminder of what extraordinary things can happen.)

而另一樣值得注意的是現時第一大市值的蘋果(市值$2萬億美元)比起30年前第一大市值的日本工業銀行市值(市值$1000億美元)高出20倍,而巴菲特認為30年後的第一大市值比現時的蘋果再高出30倍(相等於$60萬億美元市值)也不出奇,因為世界正是轉變得如此快。

(Warren Buffett: And if you look the top company at that time had a market value of a hundred billion, 104 billion. So the largest company in the world of title in just a shade over 30 years has gone from a hundred billion to 2 trillion.)

(Warren Buffett:But it tells you that that capitalism has worked incrediblt well, especially for the capitalist. And it’s a pretty astounding number. You’d think it could be repeated now that 30 years from now that you could take 2 trillion for Apple and multiply any company and come up with 30 times after the leader. Yeah, it seems impossible and maybe it is impossible, but we were just as sure of ourselves as investors and Wall Street was in 1989 as we are today, but the world can change in very, very dramatic ways.)

2. 利率是資產估值重點

市場上經常有人以「巴菲特指標」來批評美股估值已經達到瘋狂泡沫,但「巴菲特指標」其實是巴菲特在2001 年 12 月提出的,而2001年前仍然屬於相對高息年代(美國基準利率:1%至23%),我認為在2001年後的低息年代(美國基準利率:0%至5.3%)已經不適用。

巴菲特在近年亦多次提到;如果市場一直停留在零利率,股票PE將會上看100倍或200倍。

在今次的股東大會上,巴菲特再次提到利率有如股票估值的地深吸力(在2017年CNBC的節目已經說過),現時蘋果的估值並未達到瘋狂的水平。

(Warren Buffett: Well, we don’t think they’re crazy. But we don’t… at least I… Charlie… I feel that I understand Apple and its future with consumers around the world, better than I understand some of the others, but I don’t regard prices, and that gets back, well, it gets back to something fundamental in investments, I mean, interest rates, basically, are to the value of assets, what gravity is to matter, essentially.)

巴菲特說如果現時利率為10%,估值會貴很多。而現時無風險利率近乎0,任何產生現金流的資產都顯得份外吸引。你可以將這個情況理解為銀行定期存款利率10%,5%股息率的股票完全不吸引,但如果銀行定期存款利率只有0.1%呢?你的資產配置都會完全不同,因為投資就是相對的!( Warren Buffett: And essentially, if interest rates were 10%, valuations are much higher. So you’ve had this incredible change in the valuation of everything that produces money, because the risk-free rate produces, really short enough right now, nothing. )

這亦是我為什麼我經常強調巴菲特在2001年喬治亞大學(University of Georgia)的演講,強調現金流折現的重要性,當你明白現金流折現,就會更了解利率對估值的影響。

3. 輕資產企業與公用股的考慮

在2020年巴郡股東會,巴菲特提到好生意只需要很少資本投入。而今次股東會上巴菲特再次提到Google,Apple,Facebook都是需要很少資金但可以持續成長的公司,Apple的有形資產只有$370億美元,但賺的利潤比推有$1700億有形資產的巴郡還要多。這些公司都是比巴郡擁有更好的生意模式。

(Warren Buffett: Well, we’ve always known that the green business is the one that takes very little capital and grows a lot, and Apple and Google and Microsoft and Facebook are terrific examples of that. I mean, Apple has $ 37 billion in property, plant, equipment. Berkshire has 170 billion or something like that, and they’re going to make a lot more money than we do. They’re in better business. It’s a much better business than we have, and Microsoft’s business is a way better business than we have. Google’s business is a way better business. We’ve known that a long time. )

巴菲特以時思糖果說明除了資本投入不多,存貨少與應收帳少(象徵現金流周轉快)亦是一盤好生意的特徵。

(Warren Buffett: We found that out with See’s candy in 1972. I mean, See’s candy just doesn’t require that much capital. It has, obviously, a couple of manufacturing plants. They call them kitchens, but it doesn’t have big inventories, except seasonally for a short period. It doesn’t have a lot of receivables. )

巴菲特提到他一直找尋這些好生意,但這類優質股的規模未必能夠滿足巴郡的巨額投資,所以巴郡需要投資一些相對「保守」的公用股,而這些公用股的投資回報(接近9.3%)始終難以像Google那些輕資產企業的投資回報那樣高。

(Warren Buffett: We’re looking for them all the time. We’ve got a few that are pretty darn good, but we don’t have anything as big as the big guy, but that’s what everybody’s looking for. That’s what capitalism is about, people getting a return on capital. The way you get it is having something that doesn’t take too much capital. I mean, if you have to really put out tons and tons of capital… Utility business is that way. It’s not a super high-return business. You just have to put out a lot of capital. You get a return on that capital, but you don’t get fabulous returns. You don’t get Google-like returns or anything remotely close to it. We’re proposing a return in the transaction with the proposition with Texas.

If you look at the return on most American businesses on net tangible assets, it’s a lot higher than 9.3, but they aren’t utility businesses either. )

Remark:自由現金流等於經營現金流減去資本開支,而經營現金流強勁但資本開支少的企業往往能夠創造大量自由現金流,企業質素值得看高一線

2020年巴郡股東會精華重溫:2020年巴郡股東會精華重溫 股神巴菲特提6大投資重點 |三火木

4. 巴菲特在估值以外的投資思維

巴菲特在股東會上坦承減持部分蘋果持股是個錯誤,但我認為這並非一個重大錯誤,畢竟蘋果現時仍然是巴郡最大持倉,仍然為巴菲特帶來數百億美元投資回報。我的著眼點反而是巴菲特描述蘋果的細節,我想更了解他在估值以外如何了解蘋果的護城河。

巴菲特著重企業CEO質素,並讚賞蘋果CEO Tim Cook,認為蘋果仍然做到99%的顧客滿意度十分難得。巴菲特著重企業產品的口碑,曾在家具市場的數據了解蘋果手機與Android手機的分別,籍此了解到蘋果的品牌魅力(可能看到二手IPHONE更受歡迎以及價格保值)。

(Warren Buffett: So it’s an extraordinarily… Apple, it’s got a fantastic manager. Tim Cook was under appreciated for a while. He’s one of the best managers in the world, and I’ve seen a lot of managers. And he’s got a product that people absolutely love. And there’s an installed base of people and they get satisfaction rates of 99%. And I get the figures from the furniture market as to what’s being sold, and if people come in and they want an Android phone, they want an Android phone. If they want an Apple phone, you can’t sell them the other way. The brand and the product, it’s an incredible product. It’s a huge bargain to people. I mean, the part it plays in their lives is huge.)

5. 繼續無視宏觀經濟與推薦S&P500

今次股東會上有人提到1.9萬億美元的美國救援刺激計劃將可能導致急劇的通漲,而巴菲特的回覆仍然是不要去以預測宏觀經濟來賺錢,因為宏觀經濟總是我們難以預測的事情。

(價值投資大師Howard Marks同樣強調不要預測宏觀經濟)專注分析個別企業的發展才是投資者的有把握的事情。

(Warren Buffett: We don’t know what happens from the present policies. We do know, as Jay Paul said the other day, the idea that a hundred percent of GDP was some terribly dangerous level in terms of debt, that doesn’t really make a whole lot of sense now. That used to be kind of accepted wisdom. We’ve learned a lot of things we thought before weren’t true, but what we haven’t learned yet is whether what we’re doing now is true. The best thing to do is recognize you don’t know and proceed in a way where you get a decent result, no matter what happens. That’s what we try and do at Berkshire Hathaway. We do not think we can make money by making macro economic predictions. We do think we can be pretty darn sure we will get a reasonable result under policies that will not maximize results, if we could do a sort of thing.)

巴菲特仍然認為對於不懂選擇股票的人來說,買入標準普爾500指數型基金仍然是最好的選擇,而他亦安排了過世後會將90%財產買入標準普爾500指數基金,10%買入國債,顯示他是言行一致的人。

(巴菲特其實比較推薦旗下巴郡,但為了避免利益關係而推薦S&P500)

(Warren Buffett: I recommend the S&P 500 index fund, and have for a long, long time, to people. And I’ve never recommended Berkshire to anybody, because I don’t want people to buy it, because they think I’m tipping them into something I’d never. No matter what it was selling for. And I’ve made it public. On my death, there’s a fund for my then-widow, and 90% will go into an S&P 500 index fund, and 10% in treasury bills. On the other hand, I’m very happy having my future contributions to a group of charities, that’ll be spread over 12 years or so after my death, to stay in Berkshire. I think the odds are Berkshire. Berkshire is, I like it, but I do not think the average person can pick stocks.)

免責聲明:本專頁刊載的所有投資分析技巧,只可作參考用途。市場瞬息萬變,讀者在作出投資決定前理應審慎,並主動掌握市場最新狀況。若不幸招致任何損失,概與本刊及相關作者無關。而本集團旗下網站或社交平台的網誌內容及觀點,僅屬筆者個人意見,與新傳媒立場無關。本集團旗下網站對因上述人士張貼之資訊內容所帶來之損失或損害概不負責。